November Market Update

Market Indices Performance

November Recap

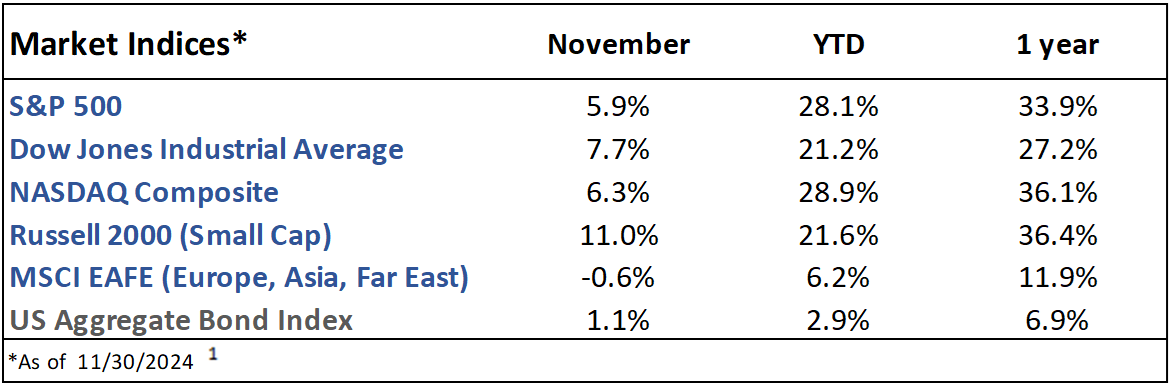

The S&P 500 rose 5.9% in November, its best month this year, and yet was outperformed by all three of its fellow domestic indices. Small caps (the Russell 2000) outperformed them all, up 11% as investors cheered Donald Trump’s victory in the presidential election and his America First policies. Bond yields ended November slightly lower after spiking on the news of Trump’s victory, even with another 0.25% interest rate cut from the Federal Reserve on November 7. Inflation, measured by the Consumer Price Index (CPI), rose 2.7% from last year, much lower than the 9.1% peak in 2022 but marking the 45th straight month above the Federal Reserve’s 2% target.(2) The economy added 227k jobs, higher than the 202k expected. The unemployment rate rose slightly to 4.2% and has been in the 4.0%-4.3% range for seven months now.(3) Job openings rose to 7.7m, and the ratio of jobs available to unemployed people remains healthily above 1 (Figure 1). (4)

Figure 1. Job openings to unemployed ratio (4)

The Present

Q3 earnings season is 99% complete; earnings have grown at ~6% year-over-year vs the~4% initially expected.(5) After spiking on the news of Donald Trump’s election victory, bond yields have retreated a bit; still, the 10yr Treasury has risen from 3.6% to 4.3% since the Fed CUT interest rates by 0.50% in September and 0.25% in November.(6) The 2yr Treasury has risen from 3.6% to 4.2% in that time (Figure 2, notice yields rising after the rate cuts).(7) This is a great reminder that the stock and bond markets are forward-looking. Rate cuts were priced in, and even a relatively short-term Treasury, the 2-year, is not guaranteed to move in tandem with the federal funds rate. The future is more important to the market than the present, and the market is not the economy. Mortgage rates have been hovering slightly above 6.5% after almost dropping below 6% in September.(8)

Figure 2. 2yr/10yr Yield Spread (7)

The Future

Analysts predict earnings growth of 12% for Q4, followed by 15% for all of 2025.(9) As for interest rates, one more 0.25% cut at the Fed’s December 18th meeting is almost a given after the latest CPI report came in at expectations. Then, 0.75%-1.00% of further cuts is expected for 2025.(10,11) December has historically been one of the best months for the market, often thanks to a ‘Santa Claus rally’ (stocks rising in the last several days of the year).(12) As for the Trump presidency, he is planning to usher in increased tariffs (likely triggering at least a short-term rise in prices), lower taxes (by extending the Tax Cuts and Jobs Act and introducing additional tax eliminations), less immigration (likely reducing the labor force), less regulation (likely spurring economic growth), and more domestic oil production (likely easing inflationary pressures across the board).(13) Plenty of uncertainty remains around these policies and how they will affect the economy, but for now, most investors seem optimistic for the future.

1. https://ycharts.com/indices/%5ESPXTR, https://ycharts.com/indices/%5EDJITR, https://ycharts.com/indices/%5ENACTR, https://ycharts.com/indices/%5ERUTTR, https://ycharts.com/indices/%5EMSEAFETR, https://ycharts.com/indices/%5EBBUSATR – Index Performance

2. https://www.investing.com/economic-calendar/cpi-733 - CPI

3. https://www.investing.com/economic-calendar/nonfarm-payrolls-227 - Jobs reports

4. https://fred.stlouisfed.org/graph/?g=12kNG - Job openings

5. https://www.reuters.com/markets/asia/china-markets-reopen-with-roar-after-week-long-break-2024-10-08/ - Earnings

6. https://www.cnbc.com/quotes/US10Y/ - 10yr Treasury

7. https://www.cnbc.com/quotes/US2Y - 2yr Treasury

8. https://fred.stlouisfed.org/series/MORTGAGE30US - Mortgage Rates

9. https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_100424.pdf - Earnings expectations

10. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html – Investor rate expectations

11. https://finance.yahoo.com/news/fed-dot-plot-suggests-central-bank-will-slash-interest-rates-two-more-times-in-2024-after-mega-50-basis-point-cut-182511834.html - Fed Outlook

12. https://www.nasdaq.com/articles/heres-the-average-stock-market-return-in-every-month-of-the-year – Monthly market history

13. https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/ - Trump presidency likely outcomes

The Gasaway Team

7110 Stadium Drive

Kalamazoo, MI 49009

(269) 324-0080

FAX (269) 324-3834

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. This presentation is not an offer or a solicitation to buy or sell securities. The material discussed is meant to provide general education information only and it is not to be construed as specific investment, tax or legal advice and does not give investment recommendations.

Certain risks exist with any type of investment and should be considered carefully before making any investment decisions. Keep in mind that current and historical facts may not be indicative of future results.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, https://adviserinfo.sec.gov/firm/summary/123807.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent.