May Market Update

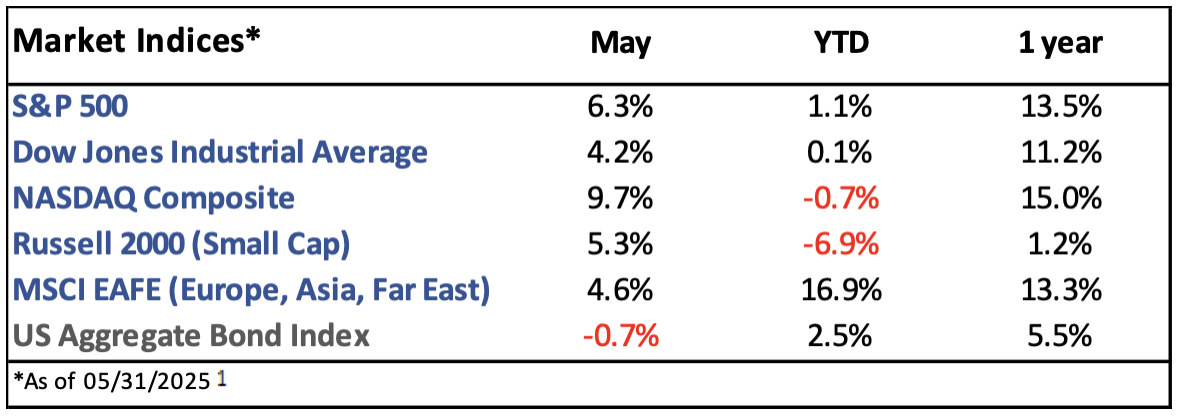

Market Indices Performance

May Recap

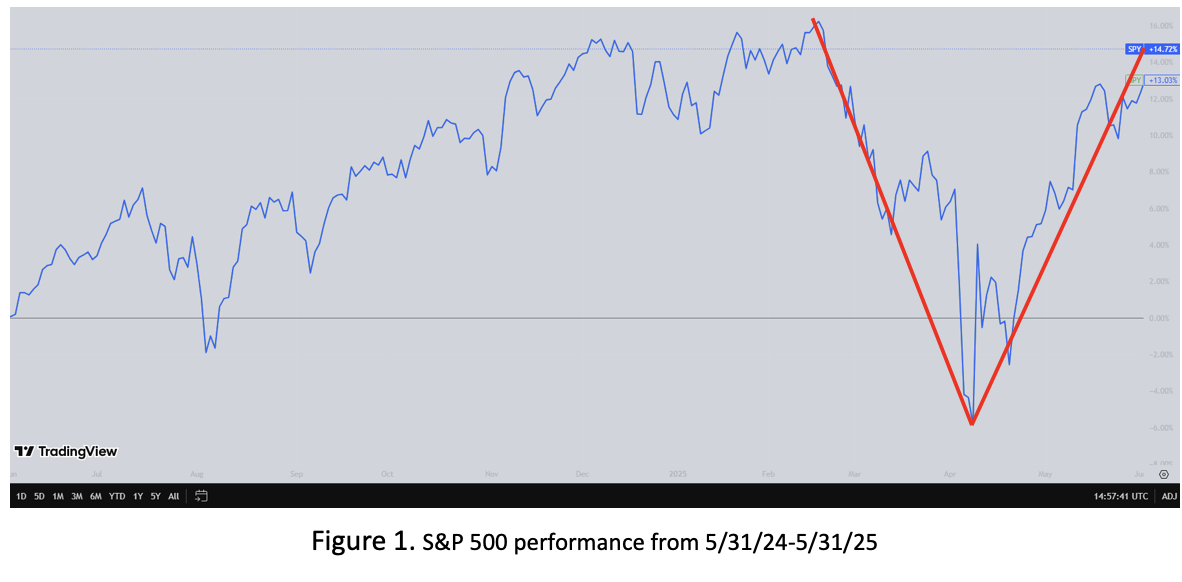

The S&P 500 rose 6.3% in May, with U.S. stocks outperforming International stocks for the first month this year. However, International stocks are significantly outperforming year to date.1 These returns helped fuel what is shaping up to be a V-shaped recovery for stocks after a tariff-driven decline in April (see figure 1).2 Bond yields rose alongside stocks as economic optimism grew and recession fears eased.

Inflation, measured by the Consumer Price Index (CPI), rose 2.4% year-over-year, marking the 51st consecutive month above the Federal Reserve’s 2% target.3 The economy added a better-than-expected 139k jobs in May, but March and April’s job gains were revised down by 95k. The unemployment rate remained at 4.2%, marking its 13th straight month in the healthy 4.0%-4.3% range; the unemployment rate has not been over 5% since September 2021.4 Job openings totaled 7.4m, pushing the ratio of openings to unemployed people solidly back above 1.5

In late May, the tariff saga continued as a U.S. court deemed President Trump’s tariffs unlawful. The ruling was quickly appealed, however, and the Court of Appeals allowed the tariffs to remain in place while a decision is reached.6

The Present

Q1 earnings concluded with 13% growth for the S&P 500 versus the 7% expected. However, these impressive results were somewhat offset by cautious forward guidance as companies grappled with tariff uncertainty and fears of an economic slowdown.7

The U.S. and China are once again meeting to discuss a trade deal after the U.S. decided to reduce its tariffs on China from over 100% to 30% for 90 days in May.8 While this obviously has implications for the economy and the market, it appears that tariff headlines have lost their shock value – similar news in April likely would have led to a multi-percent swing in the major indices, but June’s reaction has been muted.

President Trump’s “One Big Beautiful Bill” passed the House and is on the way to the Senate. It includes an extension of much of the tax cuts from the Tax Cuts and Jobs Act, along with additional tax relief like no taxes on tips. Critics, including Elon Musk, argue that the bill includes too much spending and too few cuts for a country that is $37 trillion in debt. 9

The Future

Analysts forecast 5% earnings growth for the S&P 500 in Q2 and 9% for the full year.7 Both Wall Street and the Federal Reserve anticipate two interest rate cuts in 2025, below the four cuts expected earlier this year.10,11

June tends to be an average month for stocks.12 After negative GDP growth in Q1, second quarter GDP is forecasted to be over 3% growth.13 Despite a few trade deals, uncertainty remains around future trade deals, the inflationary effects of tariffs, and the future of interest rates as President Trump continues to call for cuts.

1. https://ycharts.com/indices/%5ESPXTR, https://ycharts.com/indices/%5EDJITR, https://ycharts.com/indices/%5ENACTR, https://ycharts.com/indices/%5ERUTTR, https://ycharts.com/indices/%5EMSEAFETR, https://ycharts.com/indices/%5EBBUSATR – Index Performance

2. https://www.cnbc.com/2025/04/09/stock-market-posts-third-biggest-gain-in-post-wwii-history-on-trumps-tariff-about-face.html- Historic gains in the market

3. https://www.investing.com/economic-calendar/cpi-733- CPI

4. https://www.investing.com/economic-calendar/nonfarm-payrolls-227 - Jobs reports

5. https://fred.stlouisfed.org/series/JTSJOL- Job openings

6. https://www.reuters.com/world/us/trump-tariffs-may-remain-effect-while-appeals-proceed-us-appeals-court-decides-2025-06-11/ - Trump tariff rulings

7. https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_060625A.pdf- Earnings

8. https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/- Tariff tracker

9. https://www.yahoo.com/news/trump-wants-big-beautiful-spending-184631352.html - Big Beautiful Bill

10. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html – Investor rate expectations

11. https://www.jpmorgan.com/insights/outlook/economic-outlook/fed-meeting-may-2025- Fed Outlook

12. https://www.nasdaq.com/articles/heres-the-average-stock-market-return-in-every-month-of-the-year – Monthly market history

13. https://www.atlantafed.org/cqer/research/gdpnow- Q2 GDP

The Gasaway Team

7110 Stadium Drive

Kalamazoo, MI 49009

(269) 324-0080

FAX (269) 324-3834

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. This presentation is not an offer or a solicitation to buy or sell securities. The material discussed is meant to provide general education information only and it is not to be construed as specific investment, tax or legal advice and does not give investment recommendations.

Certain risks exist with any type of investment and should be considered carefully before making any investment decisions. Keep in mind that current and historical facts may not be indicative of future results.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, https://adviserinfo.sec.gov/firm/summary/123807.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent.