October Market Update

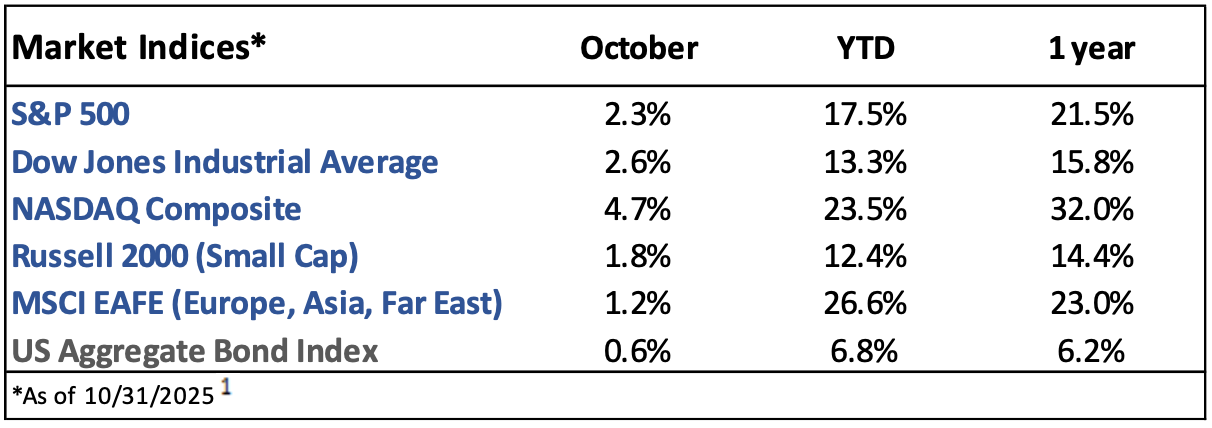

Market Indices Performance

October Recap

The S&P 500 rose 2.3% in October, hitting new all-time highs and extending its positive streak to six straight months. 1 Tech stocks led gains once again, continuing a multi-year trend of outperformance. The benchmark 10yr Treasury yield ended the month nearly unchanged at 4.1%, though it did dip below 4% mid-month.2

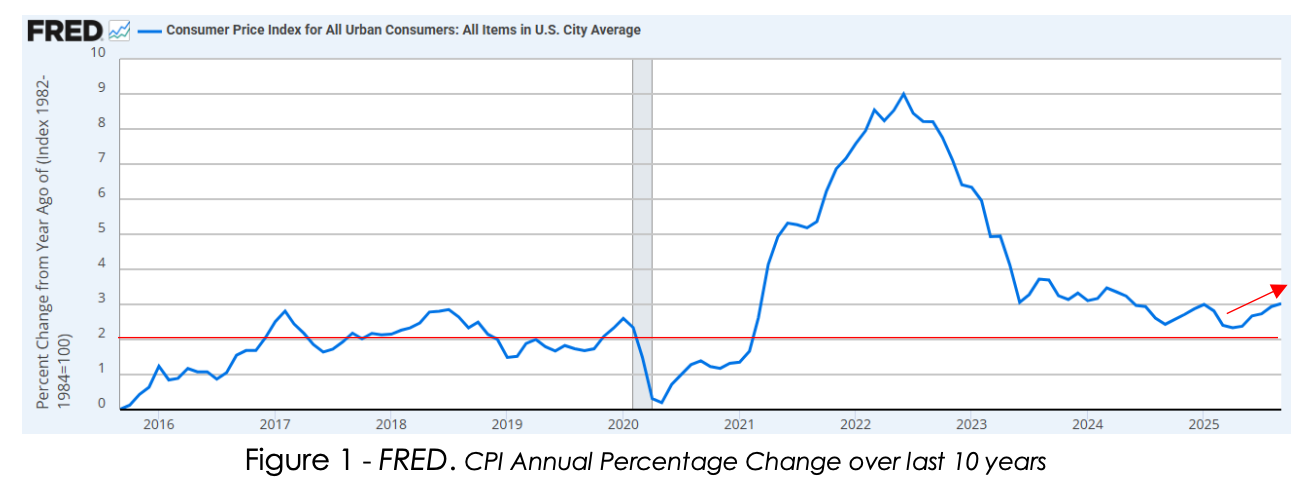

Due to the ongoing government shutdown, October’s inflation and labor market data have been delayed. September’s jobs report also remains delayed, but inflation numbers were released in late October. Both headline and core CPI came in at 3.0%, below expectations but still above the Federal Reserve’s 2% target, where inflation has remained for over 4.5 years now (figure 1).3

The Federal Reserve delivered the second rate cut of 2025 on the 29th, lowering the federal funds rate to a range of 3.75%-4.00%.4

Current Developments (November)

The current government shutdown has now surpassed the previous 35-day record to become the longest in U.S. history, but a bill to end it has finally passed the Senate and is headed to the House.5

Corporate earnings have been impressive as reporting for Q3 continues; earnings growth of 13% has far exceeded initial expectations of 7%, helping propel stocks to new all-time highs.6

A baseline 10% tariff and higher tariff rates on key trading partners like Canada (35%), Mexico (25%), India (50%), and Brazil (50%) remain in effect, while deals including 15% tariffs on most goods have been struck with Japan, South Korea, and the EU.7

The Future

Despite the broad scope and magnitude of current tariffs, their legality has come into question. The Supreme Court will rule, likely by the end of the year, on whether the enacted tariffs comply with the International Emergency Economic Powers Act (IEEPA). If not, billions in tariff revenue will have to be refunded and future tariff revenue will fall significantly.8

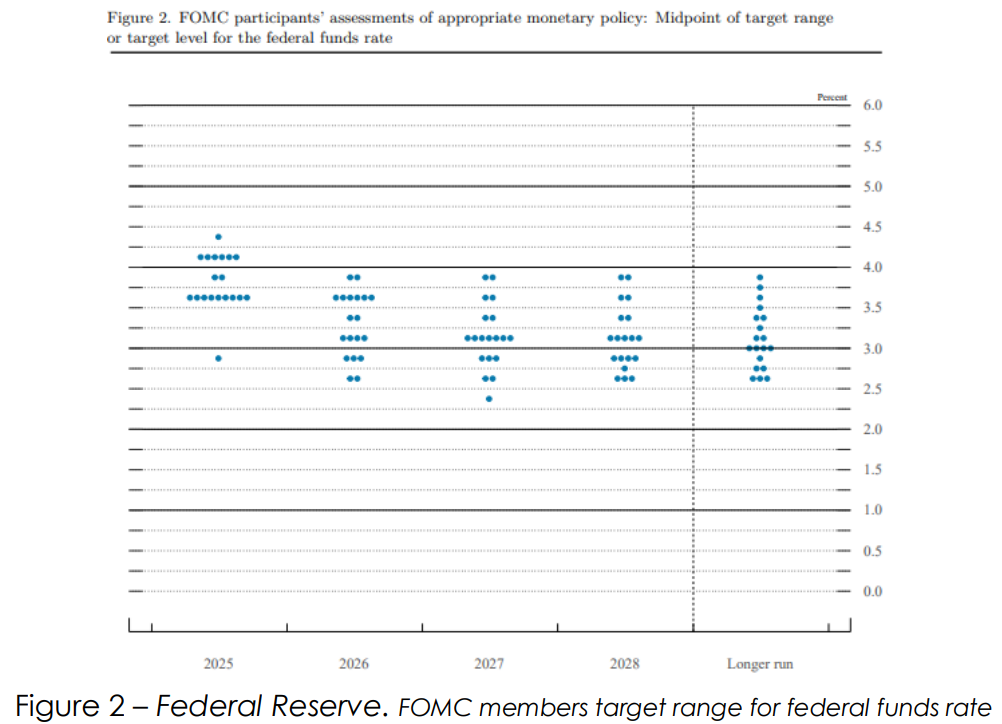

Wall Street is still predicting one final interest rate cut in 2025, which would bring the federal funds rate to a range of 3.50%-3.75%. However, Fed Chair Jerome Powell indicated that a cut in December is not a given, even after the majority of FOMC members supported one in September (figure 2). 9,10

Since 1950, November has been the best-performing month of the year for stocks.11

1. https://ycharts.com/indices/%5ESPXTR, https://ycharts.com/indices/%5EDJITR, https://ycharts.com/indices/%5ENACTR, https://ycharts.com/indices/%5ERUTTR, https://ycharts.com/indices/%5EMSEAFETR, https://ycharts.com/indices/%5EBBUSATR – Index Performance

2. https://www.cnbc.com/bonds/ - Bond Yields

3. https://www.investing.com/economic-calendar/ - Economic data

4. https://www.federalreserve.gov/newsevents/pressreleases/monetary20251029a.htm - Fed rate cut

5. https://www.cbsnews.com/live-updates/government-shutdown-latest-house-vote-senate-deal-trump/ - Government Shutdown Update

6. https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_110725B.pdf - Earnings

7. https://www.atlanticcouncil.org/programs/geoeconomics-center/trump-tariff-tracker/ - Tariff rates

8. https://www.crfb.org/blogs/tariff-revenue-soars-fy-2025-amid-legal-uncertainty - Tariff legality

9. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html – Investor rate expectations

10. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250917.pdf - Fed dot plot

11. https://www.visualcapitalist.com/charted-average-sp-500-return-by-month-since-1950/– Monthly market history

The Gasaway Team

7110 Stadium Drive

Kalamazoo, MI 49009

(269) 324-0080

FAX (269) 324-3834

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. This presentation is not an offer or a solicitation to buy or sell securities. The material discussed is meant to provide general education information only and it is not to be construed as specific investment, tax or legal advice and does not give investment recommendations.

Certain risks exist with any type of investment and should be considered carefully before making any investment decisions. Keep in mind that current and historical facts may not be indicative of future results.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website,

https://adviserinfo.sec.gov/firm/summary/123807.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent.