December Market Update

December Recap

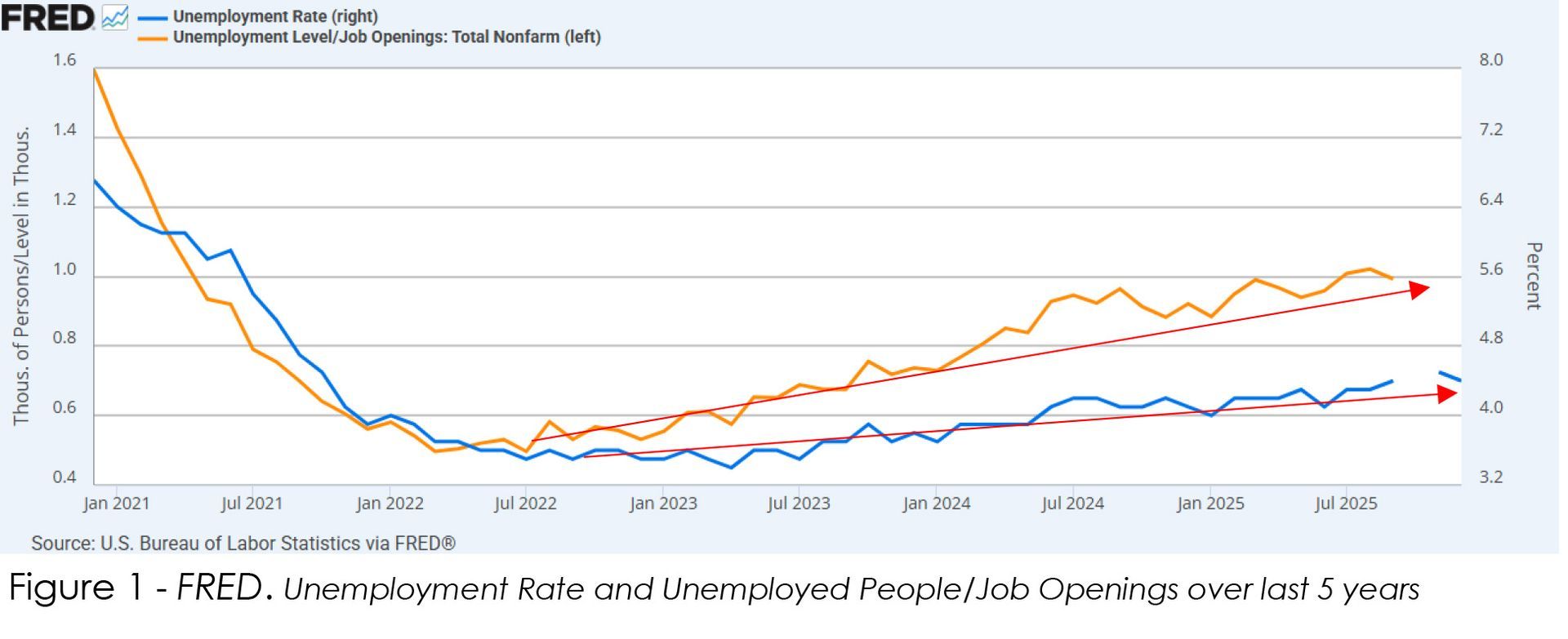

The S&P 500 rose 0.1% in December, capping 2025 with its eighth straight positive month.1 All major stock and bond indices ended the year with above-average gains, driven primarily by strong earnings and falling interest rates. International stocks outperformed U.S. stocks by a margin not seen in nearly two decades, helped by a weak U.S. dollar and increased fiscal stimulus abroad. Gold and silver ended the year with historic gains of ~65% and ~145%, respectively, as high inflation and policy uncertainty continue.2

The benchmark 10yr Treasury yield remained rangebound between 4.1% and 4.2% as investors continued to price in higher inflation and economic growth in the future.3

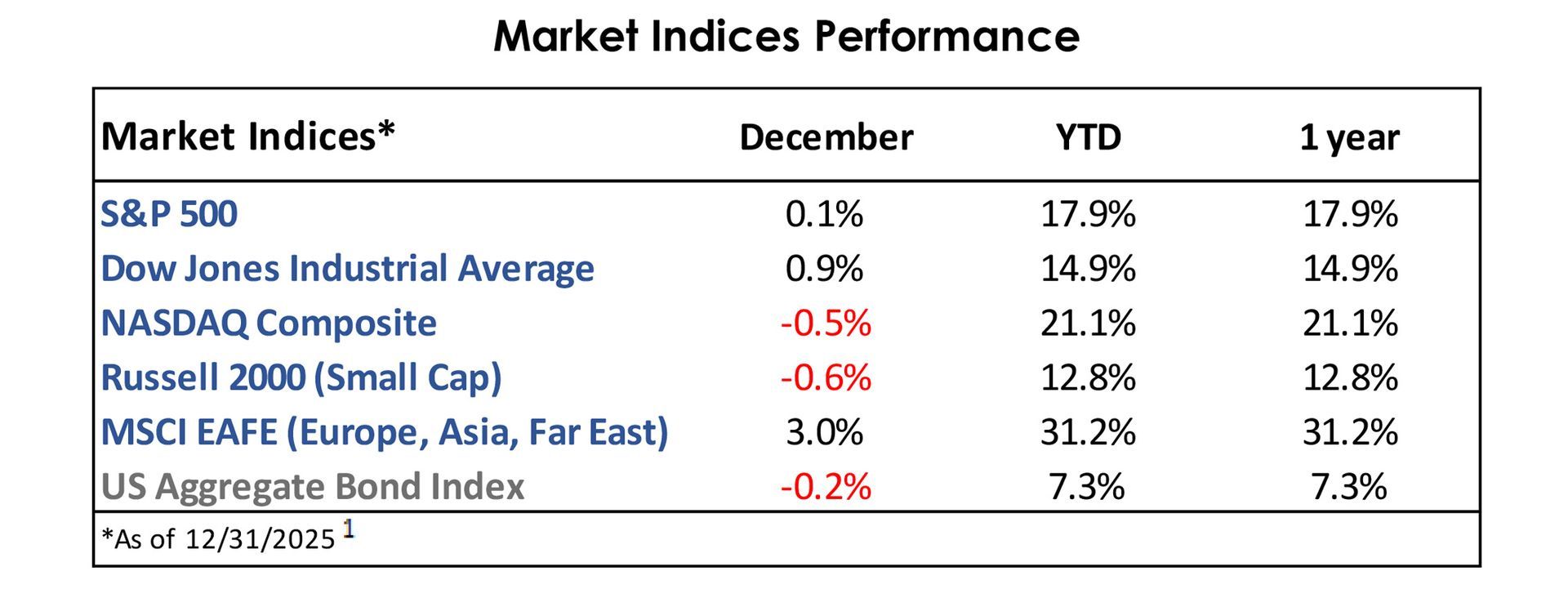

Inflation, measured by the Consumer Price Index (CPI), rose 2.7% year-over-year and has now remained above the Federal Reserve’s 2% target for more than 4.5 years. The economy added 50k jobs, continuing the trend of slowing job growth and declining job openings. The unemployment rate fell slightly to 4.4%, but remains in an uptrend since the lows of 2022 (figure 1).4

Current Developments (January)

Q4 earnings season begins in mid-January, with expectations for 8% earnings growth.5

Small-cap and Value stocks have outperformed so far in 2026, a trend we believe could continue throughout the year as earnings growth broadens from the Tech and AI names and lower interest rates work their way through the economy.1

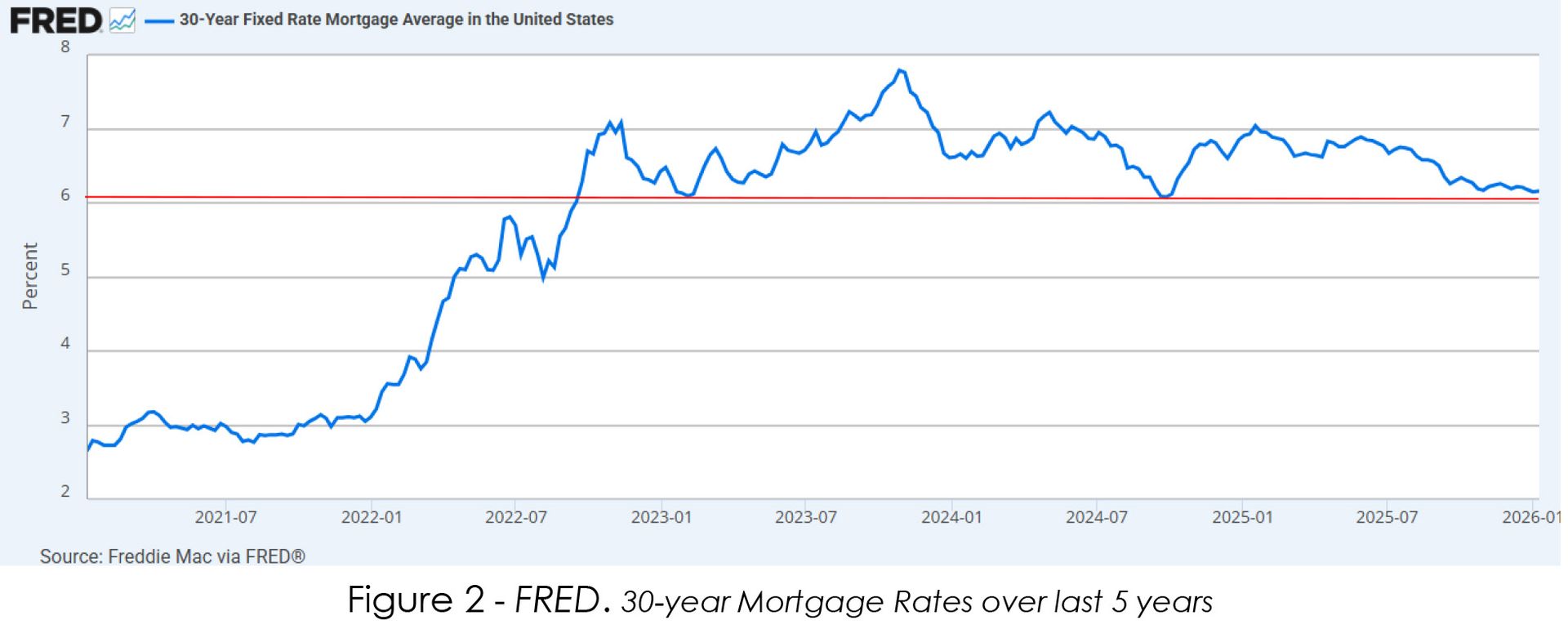

Mortgage rates remain near their lowest level in 3 years of 6.1% after several interest rate cuts (figure 2).6 President Trump ordered the purchase of $200 billion in mortgage-backed securities in an effort to push mortgage rates lower.7

Ongoing tariffs: A baseline 10% tariff and higher tariff rates on key trading partners like Canada (35%), Mexico (25%), India (50%), and Brazil (50%) remain in effect, while deals including 15% tariffs on most goods have been struck with Japan, South Korea, and the EU.8

The Future

The Supreme Court is expected to rule in January on whether President Trump’s tariffs, enacted under the International Emergency Economic Powers Act (IEEPA), are lawful. If the Court rules against the Trump administration, the administration will likely attempt alternative methods to reinstate them, though existing tariff revenue may have to be refunded somehow.9

The Federal Reserve is expected to pause interest rate cuts for several months, with Wall Street predicting two further cuts for 2026. Fed Chair Jerome Powell’s term ends in May 2026, and President Trump has indicated that he has a potential replacement in mind.10

In 2026, earnings are expected to grow 15%, with all 11 S&P 500 sectors projected to post positive growth.5

Since 1950, January has been a solid month for stocks, with an average gain of just over 1%.11

1. https://ycharts.com/indices/%5ESPXTR, https://ycharts.com/indices/%5EDJITR, https://ycharts.com/indices/%5ENACTR, https://ycharts.com/indices/%5ERUTTR, https://ycharts.com/indices/%5EMSEAFETR, https://ycharts.com/indices/%5EBBUSATR – Index Performance

2. https://www.cnbc.com/bonds/ - Bond Yields

3. https://www.investing.com/economic-calendar/ - Economic data

4. https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/Earnings Insight_120525.pdf – Earnings

5. https://fred.stlouisfed.org/series/MORTGAGE30US - Mortgage rates

6. https://www.atlanticcouncil.org/programs/geoeconomics-center/trump-tariff-tracker/ - Tariff rates

7. https://www.crfb.org/blogs/tariff-revenue-soars-fy-2025-amid-legal-uncertainty - Tariff legality

8. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html – Investor rate expectations

9. https://www.visualcapitalist.com/charted-average-sp-500-return-by-month-since-1950/– Monthly market history

The Gasaway Team

7110 Stadium Drive

Kalamazoo, MI 49009

(269) 324-0080

FAX (269) 324-3834

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. This presentation is not an offer or a solicitation to buy or sell securities. The material discussed is meant to provide general education information only and it is not to be construed as specific investment, tax or legal advice and does not give investment recommendations.

Certain risks exist with any type of investment and should be considered carefully before making any investment decisions. Keep in mind that current and historical facts November not be indicative of future results.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website,

https://adviserinfo.sec.gov/firm/summary/123807.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent.