What are Super Catch-up Contributions?

Supercharge your savings at ages 60-63

Maximize your savings with a catchup contribution

Catch-up contributions have been available since 2001 and are offered by most 401(k) plans. If you're 50 or older, you can contribute extra savings

to your retirement plan each year. This additional amount, known as a catch-up contribution, helps you grow your retirement savings faster. For example, if the regular annual contribution limit is $23,500, you may be able to contribute an extra $7,500 once you turn 50—bringing your total contribution to $31,000

Introducing the new super catch-up contribution

Starting in 2025, if you are aged 60, 61, 62, or 63, you may be eligible to contribute more to your retirement savings through a new super catch-up provision. This provision temporarily raises the catch-up limit during these four years—and only these four years— providing you with an opportunity to significantly accelerate your retirement savings. There are important age restrictions:

— You must turn 60 on or before December 31 to qualify for the super catch-up.

— You cannot contribute under this rule if you turn 64 at any point during the calendar year. For example, if your 64th birthday is on January 2, you won’t be eligible for the super catch-up that year.

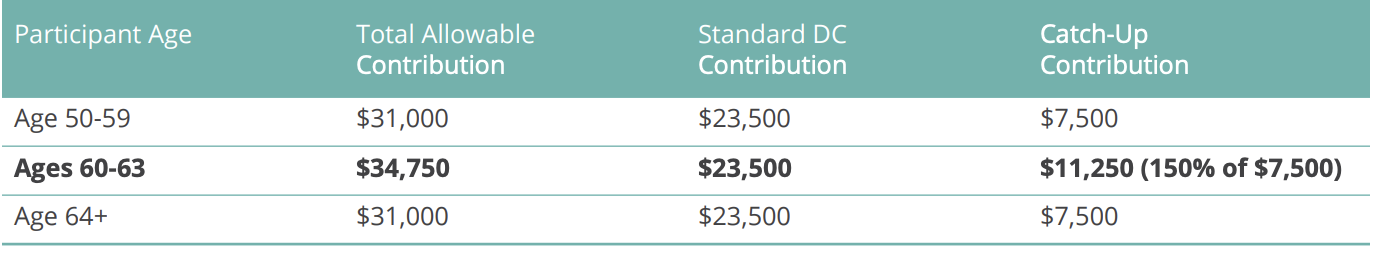

How much can you contribute?

Here’s an example of how the super catch-up increases your limit:

What should you do next?

— Ask your employer: Check if your retirement plan will offer the super catch-up option.

— Plan your contributions: Use this opportunity to increase your savings and get closer to your retirement goals.

— Reach out for support: Contact your plan administrator for more information on how to maximize your contributions.

Need guidance?

Whether you're nearing retirement or working to build your savings, we’re here to help. Contact us today to explore your options and create a plan tailored to your goals. Take charge of your financial future. Maximizing your retirement savings is one step you can take to help build financial security.

Content is for educational purposes only and should not be construed as a solicitation or offer to sell securities or provide investment, tax, or legal advice. Past performance is not indicative of future results. Investing involves risk, including the potential loss of principal. Always consult with a qualified financial advisor before making any investment decisions. Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Advisor Public Disclosure Site https://adviserinfo.sec.gov/firm/summary/123807

The Gasaway Team

Gasaway Investment Advisors

7110 Stadium Dr

Kalamazoo, MI, 49009

(269) 324-0080

info@gasawayinvestments.com

www.gasawayinvestments.com

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent.