August Market Update

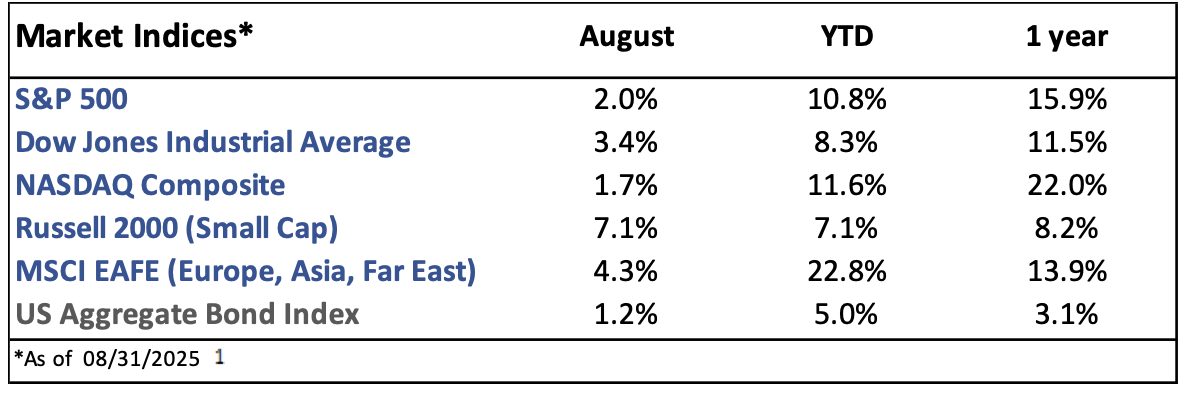

Market Indices Performance

August Recap

The S&P 500 rose 2.0% in August, reaching new all-time highs and marking its fourth straight positive month.¹ Small cap stocks outperformed as expectations for a September interest rate cut increased. The benchmark 10yr Treasury yield ended roughly where it began after a spike in the middle of the month.²

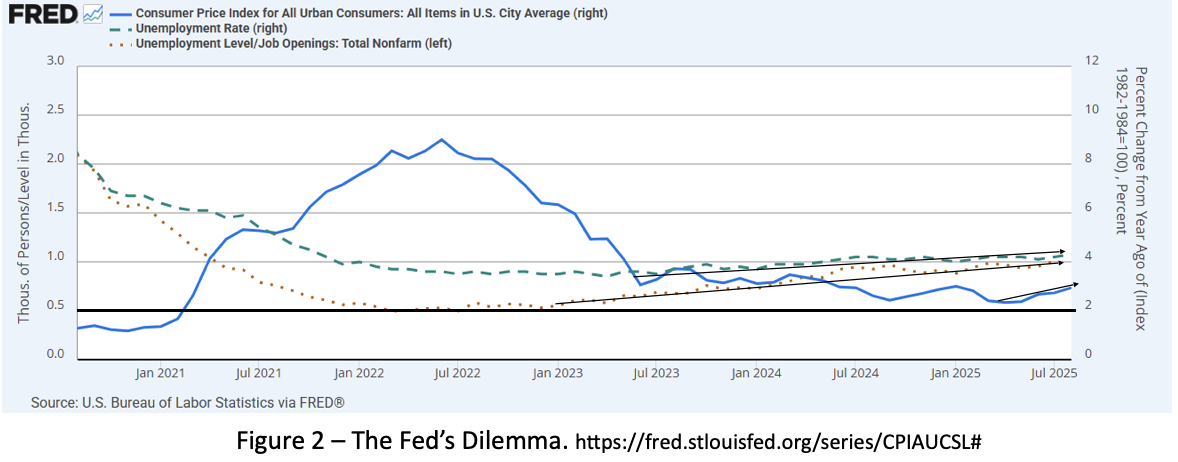

Inflation, measured by the Consumer Price Index (CPI), rose 2.9% year-over-year, marking the 53rd consecutive month well above the Federal Reserve’s 2% target.³ The labor market continued to show weakness as employers again added fewer jobs than expected (22k vs 75k). The unemployment rate ticked up to 4.3%; it has remained below 4.5% since 2021, which is well below the historical average, but the Fed does not welcome further increases (see figure 1).⁴ The ratio of unemployed people to job openings remained slightly over 1.⁵

At the annual Jackson Hole meetings later in the month,

Powell indicated that the Fed would be adjusting away from a more restrictive policy stance.⁶ Bond yields fell and stocks rose in response. President Trump’s reciprocal tariffs took effect on August 7th.⁷

Q2 GDP growth came in at 3.3%.⁸

Current Developments (September)

Following what is shaping up to be a strong Q2 earnings season, analysts expect 10% earnings growth for the S&P 500 in 2025.8 August tends to be a mediocre month for stocks and has historically marked the start of a challenging three-month stretch for markets.12

Both Wall Street and the Federal Reserve continue to anticipate

two interest rate cuts in 2025.10,11 President Trump, however, has continued to call for the Federal Reserve to cut rates by over 1% to lower borrowing costs for consumers and refinancing costs for the Treasury. Potential tariff-driven price hikes and inflation remaining well above the 2% target have made the Fed hesitant to cut rates (see figure 2).

On September 17, the Federal Reserve expectedly delivered their first interest rate cut of 2025. Powell described it as a “risk-management cut”.⁹ Short-term yields, which had dropped in anticipation of a rate cut at the beginning of the month, have since rebounded. Stagflation concerns are growing as inflation remains stubbornly above the 2% target and the labor market continues to slowly soften (see figure 2).

In defiance of historical seasonality, September has been a positive month for stocks so far. There has been little recent news on tariffs; however, reciprocal tariffs remain in effect, higher rates remain in effect on key trading partners like Canada (35%), Mexico (25%), India (50%), and Brazil (50%), a deal with China has been postponed, and key deals with Japan and the EU have been made.⁷

The Future

After Q2 delivered another quarter of double-digit earnings growth, Q3 earnings growth is expected to be 7.7%. The S&P 500’s P/E ratio of 22.6 remains well above its long-term average of 17.¹⁰ September is historically the worst-performing month for the stock market, especially in recent history.¹¹

Both Wall Street and the Federal Reserve now anticipate two further interest rate cuts in 2025 in addition to the September cut.¹² The Federal Reserve also revised its 2026 outlook, raising expectations for inflation and GDP and lowering expectations for the unemployment rate.¹³

1. https://ycharts.com/indices/%5ESPXTR, https://ycharts.com/indices/%5EDJITR, https://ycharts.com/indices/%5ENACTR, https://ycharts.com/indices/%5ERUTTR, https://ycharts.com/indices/%5EMSEAFETR, https://ycharts.com/indices/%5EBBUSATR – Index Performance

2. https://www.cnbc.com/bonds/ - Bond Yields

3. https://www.investing.com/economic-calendar/cpi-733- CPI

4. https://www.bls.gov/news.release/empsit.nr0.htm- Jobs reports

5. https://fred.stlouisfed.org/series/JTSJOL- Job openings

6. https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm - Jackson Hole speech

7. https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/- Tariff tracker

8. https://www.bea.gov/news/2025/gross-domestic-product-2nd-quarter-2025-advance-estimate - Q2 GDP

9. https://www.federalreserve.gov/newsevents/pressreleases/monetary20250917a.html - September rate cut

10. https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_091925.pdf - Earnings

11. https://www.nasdaq.com/articles/heres-the-average-stock-market-return-in-every-month-of-the-year – Monthly market history

12. https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html – Investor rate expectations

13. https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20250917.pdf - Fed Outlook

The Gasaway Team

7110 Stadium Drive

Kalamazoo, MI 49009

(269) 324-0080

FAX (269) 324-3834

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. This presentation is not an offer or a solicitation to buy or sell securities. The material discussed is meant to provide general education information only and it is not to be construed as specific investment, tax or legal advice and does not give investment recommendations.

Certain risks exist with any type of investment and should be considered carefully before making any investment decisions. Keep in mind that current and historical facts may not be indicative of future results.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, https://adviserinfo.sec.gov/firm/summary/123807.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent.