Benefits of Dollar Cost Averaging

Take Advantage Of Stock Market Ups and Downs WithDollar Cost Averaging

Investing in small but consistent increments over time may increase your earnings in the future.

STAYING INVESTED THROUGH MARKET FLUCTUATIONS CAN BE SCARY. However, by systematically investing through the ups and downs, Dollar Cost Averaging (DCA) is a powerful strategy that you can use to smooth out peaks and valleys to build long-term wealth.

HOW DOES DCA WORK?

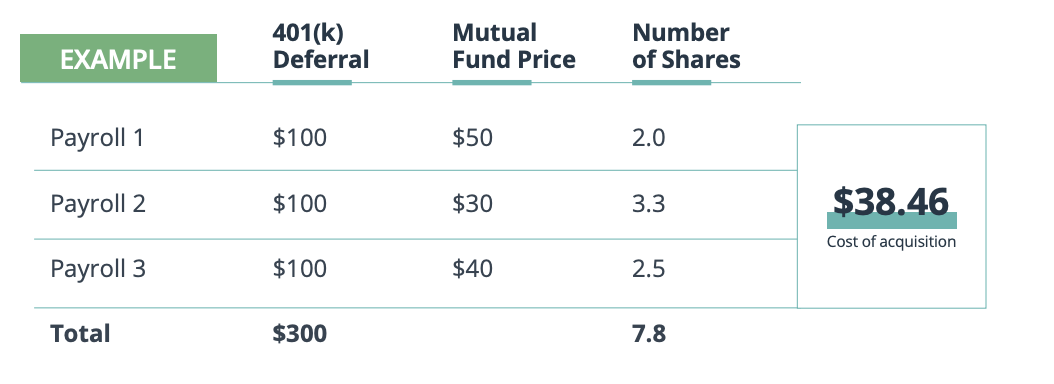

Dollar Cost Averaging is done through depositing smaller, equal amounts in the same investment, spread out over a period of time.

If you would’ve invested all $300 in the beginning at the $50 mutual fund price, you would’ve acquired 6 shares.

While the difference between 6 and 7.8 shares might seem small, by using the DCA strategy this can make a big difference in the long-term for your retirement savings account.

With Dollar Cost Averaging, you are able to take the emotion out of investing and organically take advantage of market fluctuation. Your regular deferral will buy less when the price is high and more when the price is low.

PROS OF DOLLAR COST AVERAGING

- Less investment risk than large sum deposits

- Provides a consistent strategy to help avoid the temptation to “time the market”

- Captures fluctuations in the market, especially when prices are at a discount

This format of investing is designed to weather the ups and downs of market volatility, which is why it is best to continue saving through your 401(k) and its dollar cost averaging investment strategy.

WHEN TO CONSIDER A DOLLAR COST AVERAGING STRATEGY

Dollar Cost Averaging is a strategy that helps investors capture fluctuations in the market. It provides an opportunity to take advantage of the highs and lows of the market and acquire more investments when prices are low and at a discount. Over time, this can reduce the average purchase price of those securities. Further, when markets rise, the investor has more shares and purchased at a lower overall acquisition price. Because the market has a rising tendency, this approach helps to systematically capture market ups and downs, which evens out market volatility and helps to build long-term portfolio assets.

The Gasaway Team

Gasaway Investment Advisors

7110 Stadium Dr

Kalamazoo, MI, 49009

(269) 324-0080

info@gasawayinvestments.com

www.gasawayinvestments.com

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material. ©401(k) Marketing, LLC. All rights reserved. Proprietary and confidential. Do not copy or distribute outside original intent.